Property Tax Reports

Property Tax Reports | Minnesota Department of Revenue

A collection of current and past reports produced by the Property Tax Division. Ongoing studies and reports are added each year, with additional links to supporting data and information. Annual Reports [+] Individual Reports [+] Archived Reports [+] Other Studies, Reports & Data [+] Contact Info Email Contact form Phone 651-556-3097

https://www.revenue.state.mn.us/property-tax-reports

Annual Property Tax Report - New York City

Annual Property Tax Report. These reports provide property tax data such as market and assessed values, exemptions, and abatements. The information is listed by categories, such as borough, tax class, and type of building. (Update to Cooperative and Condominium Abatement Program table on page 35 of the report.)

https://www1.nyc.gov/site/finance/taxes/property-reports/property-reports-annual-property-tax.page

Property taxes | Hennepin County

Property tax information. [email protected]. Phone: 612-348-3011. A-600 Government Center. 300 South 6th Street. Minneapolis, MN 55487. M-F, 8 a.m. to 4:30 p.m. Map. Open all. How property taxes are determined. There are a number of state laws that affect both the amount of your property tax and the way it is determined.

https://www.hennepin.us/residents/property/property-taxes

Property and Taxes | Hamilton County, IN

Property Reports and Tax Payments. Use this application to: make and view Tax Payments, get current Balance Due; view and print Tax Statements and Comparison Reports; view Ownership Information including Property Deductions and Transfer History; view and print Assessed Values including Property Record Cards.

https://www.hamiltoncounty.in.gov/685/Property-and-Taxes

Property Tax Payment Information - King County

Many changes have been made to the property tax exemption and deferral programs for seniors, people with disabilities, and military veterans with a service-connected disability. Instead of a fixed amount, the annual income limit is now indexed at 65% of the median household income in King County, which for 2019 was $58,423.

https://kingcounty.gov/depts/finance-business-operations/treasury/property-tax.aspx

Property Tax | Denton County, TX

Property Tax Office. Email Property Tax Office. Physical Address View Map 1505 E McKinney Street Denton, TX 76209. Directions. Mailing Address P.O. Box 90223 Denton, TX 76202. Phone: 940-349-3500. Fax: 940-349-3501. Locations. Alternate Phone: 972-434-8835. Building: Mary and Jim Horn Government Center ...

https://www.dentoncounty.gov/821/Property-Tax

Property Tax Information | Lucas County, OH - Official Website

Property Tax Definitions Property Tax - A tax on the real property owned by residents and businesses. Property tax includes the land and structures. Mill - Property tax is measured in mills. A mill means 1/1,000. Therefore, each mill generates $1 of taxes for every $1,000 of a property's assessed value.

https://www.co.lucas.oh.us/392/Property-Tax-Information

Los Angeles County - Property Tax Portal

Assessor, Auditor-Controller, Treasurer and Tax Collector, and Assessment Appeals Board have prepared this property tax information site to provide taxpayers with an overview and some specific detail about the property tax process in Los Angeles County. Jeffrey Prang Assessor

https://www.propertytax.lacounty.gov/

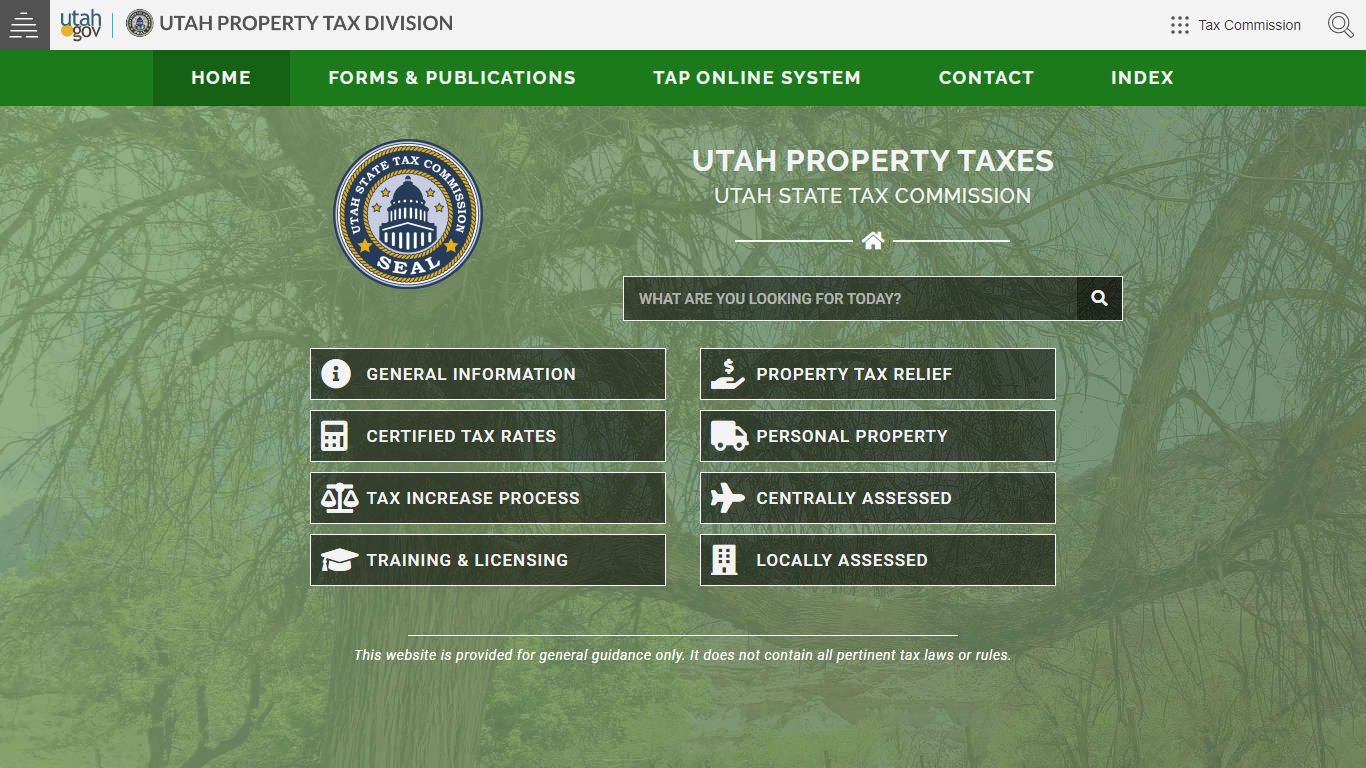

Utah Property Taxes – Utah State Tax Commission

Official site of the Property Tax Division of the Utah State Tax Commission, with information about property taxes in Utah.

https://propertytax.utah.gov/

Real Estate Property Taxes - Municipality of Anchorage

The Municipality's 2022 real property tax notices will be mailed by June 30 . For Tax Year 2022 Only! Taxes on real property are due on July 31 or may be paid in two separate payments with the first half due July 31 (Late penalty assessed August 8) and the second half due September 30 (Late p enalty assessed October 8) . Payments are considered ...

https://www.muni.org/Departments/finance/treasury/PropTax/Pages/RealEstatePropertyTaxes.aspx